6 Ways Business Owners Can Survive the Small Business Rent Crisis

The rent crisis in America is the worst nightmare for small businesses. Commercial rent has been rising at an alarming rate, while consumer spending remains relatively unchanged. This perfect storm has left small businesses across the country struggling to keep up with their rental payments.

In Los Angeles, the small business rent crisis has been especially devastating. During COVID-19, the city experienced the highest rate of business closures in the country, with 7,500 shutting down for good. Now, with skyrocketing rent making it impossible for small businesses to keep up with expenses, even more companies are set to close. But the Los Angeles rent crisis is just a reflection of the larger rental crisis facing small businesses across America. In New York City, San Francisco, and other major cities throughout the country, small businesses are being priced out of their neighborhoods by rising rents

According to a survey conducted by Alignable, 45% of small businesses are being forced to pay rent which is at least 50% higher than it was pre-COVID. A further 12% said their rent had increased three-fold since before the coronavirus pandemic. These alarming figures show just how severe the rent crisis has become for small businesses in America. As a result, many of these small businesses are unable to pay their rent, which means they are at risk of eviction. A shocking 40% said that they were behind on their rent, which is a 6% increase since July of this year.

What’s Causing the Small Business Rent Crisis?

There are several factors that have contributed to the current business rent crisis in America, but the origins of the phenomenon can be traced back to the Great Recession of 2008. In the aftermath of the financial crisis, the construction of new houses and commercial properties ground to a halt. However, over the following decade, the population grew by 7.4%, outpacing the construction of new homes and rental properties by a considerable margin. This imbalance peaked in 2011 when only one property was constructed for every five people added to the population. In the years since, construction rates have slowly risen, but not nearly fast enough to meet the needs of the growing population.

The combination of a growing population and a limited number of rental properties has resulted in a severe shortage of rental units across the country. This has put upward pressure on rent, with tenants competing for a limited number of units. To make matters worse, we are currently experiencing unprecedented rates of high inflation. Landlords are quick to raise the rent when inflation rates increase, but small businesses often cannot pass these increased costs on to their customers. Rising costs for goods and services, combined with stagnant wages, have made it difficult for small businesses to keep up with their expenses. Some of these businesses have been forced to resort to seeking rental assistance, while others have simply chosen to close their doors.

The ongoing energy crisis has added an additional factor to consider when regarding the small business rent crisis. In many parts of the country, small businesses are struggling to keep up with rising electricity and gas bills. Consumers are also feeling the pinch, as utility bills continue to eat into their budgets. This has resulted in a decrease in consumer spending, which has put small businesses in a difficult position. Many are struggling to generate enough revenue to cover their expenses, let alone turn a profit. When asked about the main factors contributing to their inability to afford rent by Alignable, businesses cited a variety of challenges, including the sudden rent spike, high gas prices, increased cost of supplies and labor, the downturn in consumer spending, and other emerging recession-related trends.

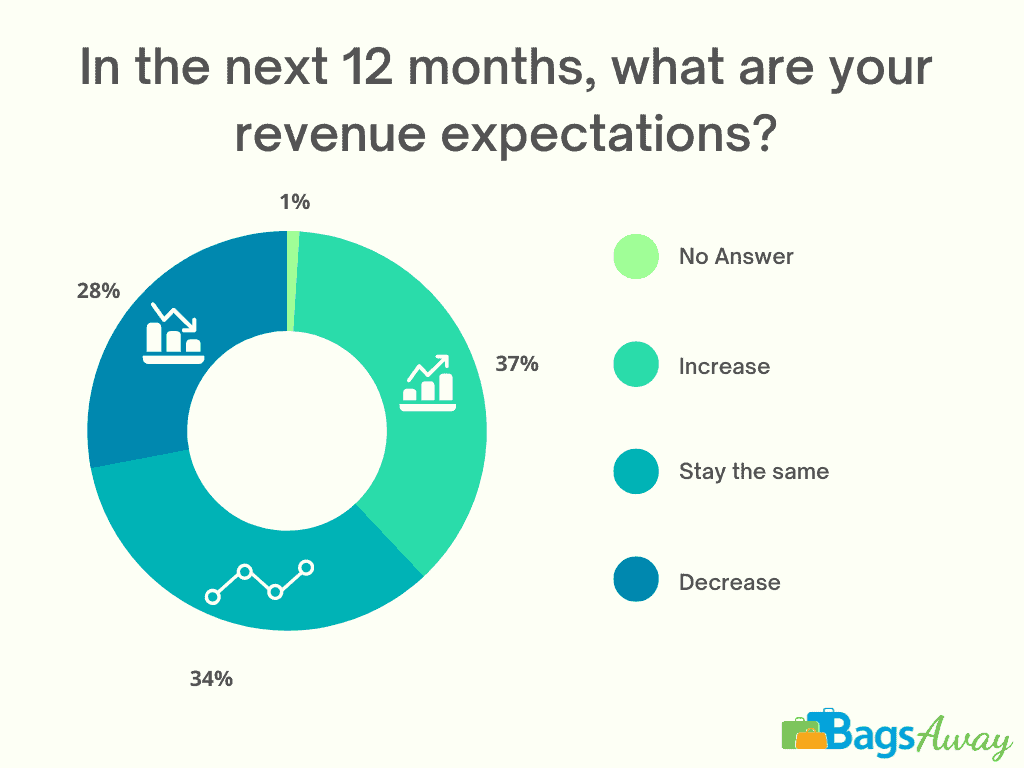

A survey led by CNBC revealed similar trends, with only 34% of small business owners stating that they believed current conditions for their business were “good”. 28% of respondents also said they expected their revenues to decrease over the next 12 months, which is up from 21% in the previous quarter. If these trends continue, small businesses will face an even tighter squeeze, making it difficult for them to stay afloat.

How Your Small Business Can Generate Alternative Revenue

The current rental crisis is a perfect storm of factors that have combined to create an impossible survival situation for small businesses. Although remote working is beneficial for businesses like essay writing services, it can often be unfeasible for small businesses, so they need to get creative to generate alternative sources of revenue. Here are a few innovative ways small businesses can keep their doors open during the current rent crisis.

1. Renegotiate Your Commercial Rent

If you’re a small business owner, you might feel intimidated by the prospect of renegotiating your commercial rent with your landlord. But it’s important to remember that you have leverage in this situation. Many small businesses are in the same boat during the rental crisis, and landlords are starting to realize that they need to be more flexible in order to keep their tenants.

With the rise in remote working, commercial landlords are also starting to see the value in offering lower rent to keep their buildings filled. Ultimately, it’s better to have a tenant paying lower rent than no tenant at all. Here are a few tips on how to negotiate your commercial rent reduction:

Do your research. Before you start negotiating with your landlord, it’s important to understand the market rates for commercial rents in your area. This will give you a better idea of what fair rent would be and it will also help you to justify your position to your landlord.

Ask yourself if you’re prepared to walk away. It’s important to go into any negotiation with the mindset that you’re prepared to walk away if you don’t get what you want. If you’re not in a position to do this, then you’re less likely to be successful in negotiations.

Be reasonable. It’s important to remember that your landlord is also feeling the squeeze of the current business rent crisis. They may be open to negotiation, but they’re not going to give you a huge discount. It’s important to be reasonable in your expectations to come to an agreement that works for both parties.

2. Become a Luggage Storage Host

This might seem like an unconventional way to generate revenue, but offering luggage storage is actually a great way to make some extra money during the small business rent crisis. With relocation travel growing more popular, remote workers of all kinds are leaping at the opportunity to travel while they work. As such, they often need a place to store their luggage while they’re on the go. That’s where luggage storage hosts can make some money.

One of the ways you can start offering luggage storage is to sign up with a service like BagsAway. Once you’re registered, you can list your business as a luggage storage location and start accepting customers. This is a great way to generate some extra revenue, and it doesn’t require any major changes to your business. You just need to have a bit of extra space that you can use to store luggage. To get started, simply fill out BagsAway’s partner registration form to setup your account and get your listing up and running in no time. Popular cities include Los Angeles, New York City and Miami, in addition to popular destinations in Canada, Europe and beyond. With new locations added daily around the world, you too could benefit from an added stream of revenue without hiring additional staff or investing in new equipment or supplies. You’ll also be able to set your own rates and storage capacity by limiting the number of items you accept on any given day.

3. Subdivide Your Store or Office Space

If you have a large store or office space, you might be able to subdivide it and rent out part of the space to another business. This can be a great way to generate some extra income and help you save money on your rent. For example, if you run a convenience store, you might be able to rent out part of your space to a hot food vendor. By providing an additional service without the hassle of actually running it, you can make your business more attractive to customers and generate some extra revenue through the rental agreement.

There are a few things to keep in mind if you’re thinking about subdividing your space:

Make sure it’s legal. Before you do anything, it’s important to ensure that subdividing your space is legal. There may be clauses in your lease agreement that prevent you from doing this, so check with your landlord before moving forward.

Consider the logistics. It’s important to think about the logistics of subdividing your space. For example, will you need to install additional walls or partitions? How will you divide up the common areas like bathrooms and kitchens? These are all important factors to consider before you proceed.

Draft a clear agreement. It’s essential to draft a clear and concise rental agreement. This should spell out the terms of the agreement, including how long the rental period will be and how much rent the tenant will pay.

It goes without saying that this option isn’t right for every small business. You’ll need to have a large enough space to make subdivisions and be prepared to share your space with another business. But if you’re willing to make some changes, this can be a great way to stay afloat during the current rental crisis.

4. Open a Coworking Space

Traditional office spaces are becoming increasingly outdated whilst the popularity of coworking spaces is on the rise. Shared work environments offer various benefits, including flexible lease terms, a collaborative environment, and a sense of community. For small businesses, opening a coworking space can be an excellent way to brave the current small business rent crisis.

However, there are a few things you’ll need to keep front of mind if you’re thinking about opening a coworking space:

Enough space. First and foremost, you’ll need to have enough space to accommodate multiple workers. This means having enough space to fit multiple desks, chairs and small meeting areas.

The right amenities. In addition to having enough space, you’ll also need to make sure your coworking space has the right amenities. This might include Wi-Fi, printers and scanners, toilets, and even coffee and tea-making facilities.

High-speed Internet: High-speed Internet access is a must for any coworking space. A shared work environment must have a reliable and fast broadband connection to accommodate the needs of digital nomads and remote workers.

Comfortable furniture: Finally, you’ll need to ensure that your coworking space is furnished with comfortable and functional furniture. This might include ergonomic chairs, adjustable desks, or even standing desks.

5. Set up a Mini Photography Studio

This suggestion may seem out of the left field – but hear us out! Setting up a small photography studio in your business space can be a great way to make some extra money. Photographers need a place to shoot their photos, but the space doesn’t have to be huge. With a few well-placed lights and some simple backdrops, you can easily transform a small corner of your space into a mini studio.

You might want to invest in some basic photography equipment, like lights and backdrops to get started. And if you don’t have the budget for that, you can easily find some great second-hand deals. Once you’ve got your studio set up, you can start marketing it to local photographers. Setting up a small photography studio is relatively low-cost and straightforward. With some creative marketing using a digital marketing agency, you could soon start generating some extra income to cover your rent during the business rent crisis. You could also consider leveraging specialized digital marketing services to reach a broader audience and maximize your return on investment.

6. Host a Pop-up Shop

Plenty of small businesses want the ability to sell their products in person, but they don’t necessarily want to commit to a brick-and-mortar store. They may not have the budget for it, or they may not want the hassle of dealing with a long-term lease in the middle of the business rent crisis. Some of them decide to get around this by hosting pop-up shops.

A pop-up shop is a temporary retail space that small businesses can use to sell their products. Pop-up shops can be a great way to generate extra income or test out a new product or market. If your business has the space for a small stall or temporary installation, then you could target fellow small business owners who are looking for a place to sell their products.

Here are a few ways to market your space to potential pop-up shop tenants:

Use social media. Social media is a great way to reach small businesses that might be interested in renting your space for a pop-up shop. Use hashtags, post about your available space, and tag relevant small businesses in your posts.

Contact small businesses directly. If you know of any small businesses that might be interested in renting your space, don’t hesitate to reach out to them directly. Send them an email or give them a call to let them know about your available space. consider using email marketing software available in the US to streamline your outreach and increase engagement.

Advertise in relevant online directories. There are plenty of online directories that list available retail spaces for rent. Create a listing for your space in one of these directories to reach small businesses that might be interested in renting your space.

Use signage. If you have a storefront, use signage to let small businesses know that you’re renting out space for pop-up shops. You could even put up a sign on your window saying something like, “Pop-Up Shop Available!”

Your Small Business Can Survive the Rental Crisis

It might seem like small businesses are being pushed out by the current rent crisis, but there are some effective methods that will help you survive — and even thrive. By getting creative and thinking outside the box, small businesses can find innovative ways to make ends meet while generating revenue for small business. Utilizing business plan templates can also help entrepreneurs map out new strategies to navigate the rent crisis effectively. Renting out some space to remote workers, renegotiating your commercial rent, or signing up to start hosting luggage storage are just some of the ways to make it through the small business rent crisis and come out even stronger on the other side. You can also explore aliexpress dropshipping to diversify your income streams without taking on additional rent or inventory risk.

Rental Crisis FAQs

Why is the Rent So High?

The rental market is determined by supply and demand, so if there are more people looking for rental properties than there are units available, the rent will be high. However, in the current climate, the sudden rise in rental costs can also be attributed to several factors including rising inflation rates, a global energy crisis, and a lifeless economy.

Why is the Business Rent Crisis so Difficult to Tackle?

There are several reasons why the rent crisis is difficult to tackle. For starters, it’s hard to control the rental market. The rental market is partially determined by supply and demand, and it’s difficult to quickly increase the supply of rental properties. Additionally, the rent crisis is difficult to solve because it’s not just one problem. The business rent crisis is a symptom of many different problems that are tied in with global economic issues.

How Can We Solve the Small Business Rent Crisis?

There is no one-size-fits-all solution to the rent crisis. Instead, various solutions must be implemented to solve the problem. Some of the proposed potential solutions include increasing the supply of rental properties, capping rent increases, and providing financial assistance to renters.